Gordian’s RSMeans™ Data is North America’s most comprehensive, and most trusted, construction cost database. Containing upwards of 92,000 construction material, labor and equipment costs, RSMeans Data is prized by architects, engineers and contractors for accurate and current prices.

Regular, comprehensive updates to the database make it a reliable resource for construction professionals. They also empower Gordian’s internal team of data analysts and cost engineers to track long-term price trends, providing industry executives and leaders with insights they can use to weather cost volatility, stay ahead of the curve and make more informed business decisions.

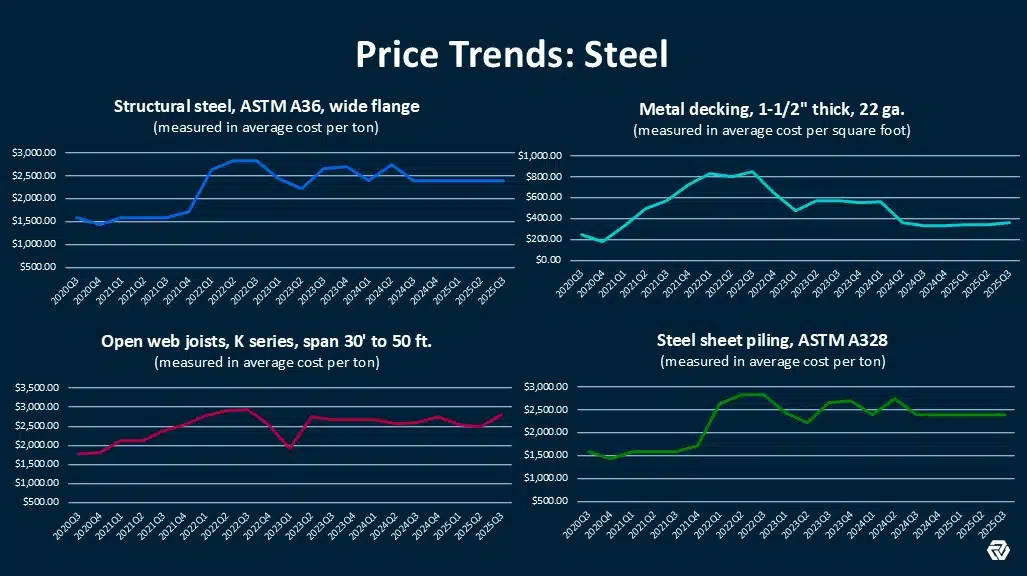

In this blog post, we will use RSMeans Data to provide a quarterly analysis of the price of steel, one of the construction sector’s most vital materials.

DISCLAIMER: The prices referenced below represent the national average and are used for reference purposes only. Costs in your local market may differ.

Tracking the Price of Steel With RSMeans Data

January 2026

Steel prices start the new year in a slump, dropping 5.38% since the last quarter of 2025. Year-over-year costs slip 7.18%, and the price of structural steel is down to $2,343.93/ton in January 2026.

October 2025

The price of structural steel in October 2025 is $2,477.25/ton. Following the first increase in over a year, steel costs dip by 6.63% from Q3 to Q4. Year over year, structural steel prices are down 4.7%, the latest in what’s been a longitudinal decline.

July 2025

The national average price of structural steel is $2,653.03/ton in July 2025. After a prolonged and precipitous drop, steel prices bump up 2.06%, the first increase in over a year. While overall steel costs are up a mild 1.85% since last quarter, the price of specific steel items has spiked dramatically. The price of open web joists, for instance, is up 12% nationally.

April 2025

Steel prices rebound, jumping 3.15% from Q1 to Q2 of 2025. That’s the silver lining. Here’s the dark cloud: Year over year steel costs continue to slide, down approximately 10.5% since this time last year. Gordian anticipates that slide will stop in the second half of 2025, possibly sooner, as it appears steel tariffs are here to stay and the fact that Nippon’s acquisition of U.S. Steel is still in limbo.

January 2025

The cost of steel tumbles 2.85%, continuing a long-term trend that has seen prices plummet over 16.5%. With the future of the U.S. Steel Corporation in question and steeper tariffs looming, the ripple effects on the price of steel have the potential to be both lasting and profound.

October 2024

Steel prices find their footing after a 10% plummet from Q2 to Q3. While prices are down 14% since this time last year, they have stabilized.

July 2024

After a brief period of stability, structural steel beam prices decline by nearly 10% per ton. Other construction industry experts have corroborated this drop, believing there’s little fear of supply shortages, and that price declines are likely to continue.

April 2024

Cold rolled steel prices have been volatile for the past three years. The increases that came due to inflation, the pandemic and material shortages in the latter half of 2021 and through 2022 were felt quickly by end users. Raw prices in 2023 were also unstable, leaping and diving over 50% during the year. Only now, at the start of 2024, are we seeing some notable price drops for end users, with decreases of 10% or more in many areas.

January 2024

Structural steel prices maintain equilibrium into the new year, and there are no signs of volatility on the horizon. Our most recent analysis points to small but consistent cost increases for 2024.

November 2023

The metals division of RSMeans Data shows a 3.1% jump in steel costs year-over-year, with metal stairs bearing the most responsibility for the uptick. Steel prices stabilize in the back half of 2023, but reduced international demand, particularly from Asian markets, and increased domestic costs create the conditions for price uncertainty heading into 2024.

Get analysis and commentary on construction material prices and labor costs, including quarterly reports, in this resource hub.

July 2023

The first half of 2023 is a period of relative calm and steel price regression. On average, costs are down approximately 25% from the third quarter of 2022 and 35% from the end of 2020. Forecasts for the price of steel are mixed for the second half of the year.

January 2023

The average unit cost increase in the RSMeans Data metals division is just shy of 22%. Rising steel prices and aluminum costs are among the factors contributing to the spike as do inflation and war in Europe. U.S. mill prices drop in the latter half of 2022, indicating that production and demand are coming into balance. Gordian analysts predict steel costs will stabilize in 2023.

November 2021

Structural steel prices hike an astonishing 43% from Q1 2020 to Q1 2021, and the end of 2021 brings an additional 82% surge. This relentless escalation in steel costs significantly impacts related materials. Metal decking, essential for commercial roofs and floors, experiences a staggering 295% cost increase over the course of the year. The price of steel rebar, a crucial product for reinforcing concrete in large commercial projects, jumps 119% in the same period. These sharp rises reflect a broader trend of supply shortages and increased demand, causing widespread concern across the construction industry.

May 2021

Structural steel prices skyrocket in 2021, with costs climbing 91% since the end of 2020, including a 45% increase in the year’s final quarter. This volatility, exacerbated by tariffs introduced in 2018, marks a significant departure from the relative stability of steel costs in 2019 and 2020, when prices showed less than a 2% change. The cost spike not only affects construction projects but also consumer goods like appliances and cars, leading to higher prices and manufacturing delays.

February 2020

Stainless steel costs grow by 7% from 2019 to 2020. To put that into real dollars, the price of type 304 stainless steel sheeting went from $4.66 to $5.00 in one year. Multiply that difference over thousands or tens of thousands of sheets and it adds up to a financially significant increase. This cost escalation is driven by a spike in the costs of steel fabrication installation, rising transportation costs and the economics of supply and demand.

September 2018

Gordian’s analysis of a steel price index comprised of different steel materials shows an 8% increase in May of 2018, the highest increase since early 2017. Steel tariffs cause the index to climb by 5.5% in July and an additional 5% in August.

A quarterly steel price analysis reveals a 12% escalation from Q1 to Q2 of 2018, the largest quarterly increase since 2016 and the first consecutive quarterly increase since 2014. This back-to-back hike breaks a longstanding pattern of large cost fluctuations followed by proportional corrections. Overall, Gordian’s steel price index reveals a surge of 26% since January 2018.