Ideas for Navigating Inflation

The key topic at every recent federal construction event (SAME JETC, AGC FedCon and the DBIA Federal Symposium) has been how to handle unprecedented construction costs inflation and supply chain uncertainty. Federal contractors are feeling the pinch of material pricing that is sometimes only honored for days when federal award cycles can take up to a year. MILCON budgets, which are established years in advance, are being blown, putting mission-critical projects at risk. Industry and government are seeking new ways of collaboratively managing a volatile market.

ConsensusDocs 200.1 Time and Price Impacted Materials provides a legal framework for owners and contractors to agree on some methodology for escalation and de-escalation of material costs. But it leaves the specific methodology for doing so undefined.

While some contractors are going so far as to recommend Cost Plus contracts (virtually unheard of in major construction programs), the U.S. Army Corps of Engineers (USACE) is experimenting with a bidding strategy called PIVOT contracts (Prices Include Variation Over Time) and asking for additional ideas and insights from industry organizations. The ideal solution must fairly distribute and manage risk for contractors and federal agencies, much like force majeure or concealed conditions clauses do.

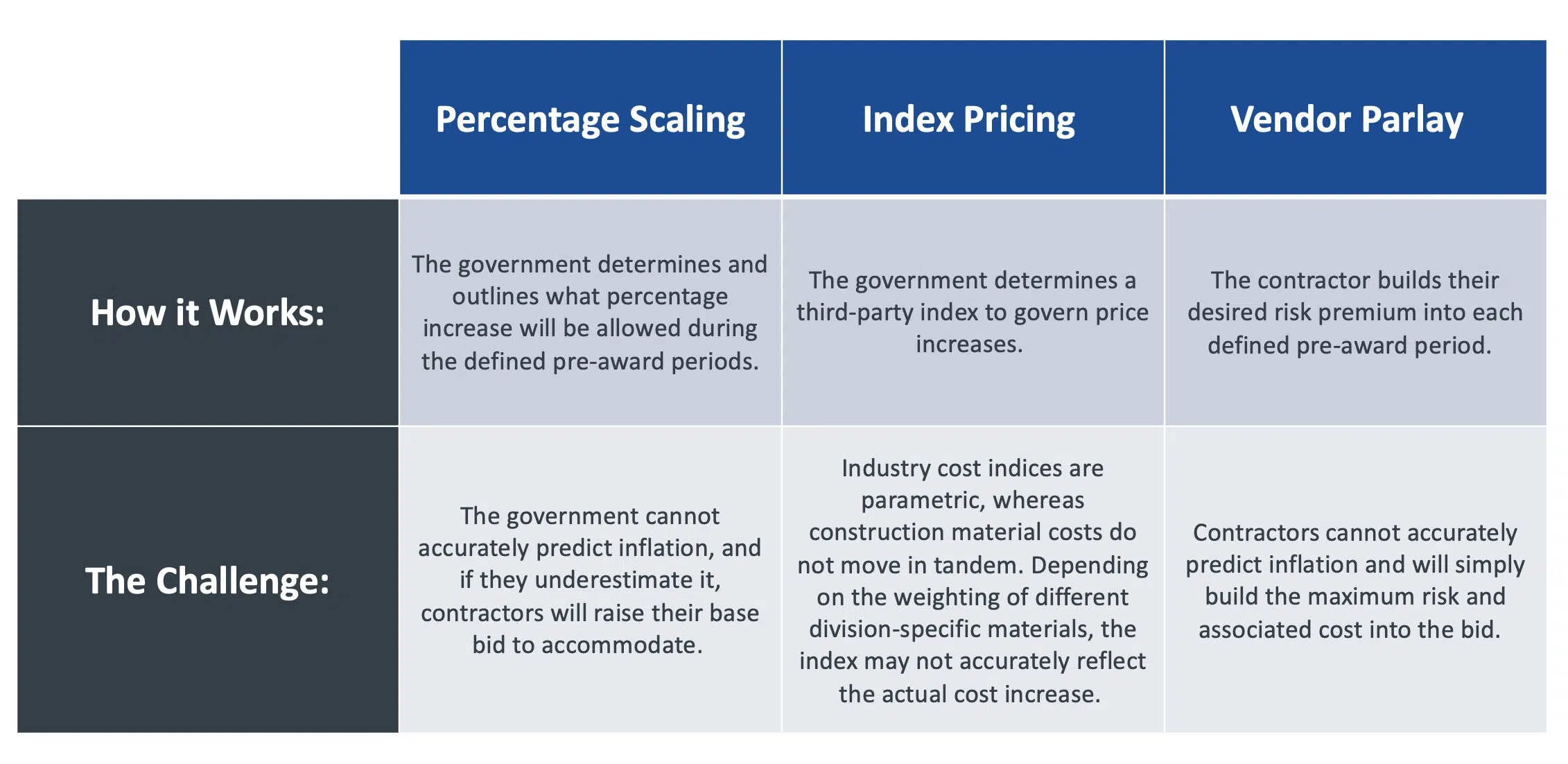

What implications does this have for the experiments with PIVOT contracts? USACE envisions three potential ways to escalate the contract bid during pre-defined periods:

Is it possible that there is a better, fourth way? MILCON estimating process and tools – intersected with Gordian data innovation – provide the potential for one.

A History of Cost Escalation and Inflation Expertise

Gordian’s Federal Solutions and Data teams have been looking at previous federal client engagements and our data innovation initiatives to understand how we can help private industry with this challenge. Our experience supporting the Bureau of Labor Statistics Non-Residential Building PPI with cost models and quarterly RSMeans Data has provided us with insight into how material price inputs and selling price correlate.

Further, our expert team has longstanding and recent experience in helping government and industry with the thorny problem of cost escalation during an extended period of significant construction cost inflation. During the long implementation of Army Housing Privatization, our cost researchers and engineers helped the Army and contractors, like Clark Construction and Lend Lease, arrive at a market-informed cost escalation methodology. Army Housing Privatization included payment for the build-out of hundreds of housing units across nearly a decade-long contract (in addition to the renovation of units and ongoing operations) in both major metropolitan areas and remote areas like Alaska.

Several of these programs relied on a component-level baseline bid, upon which the Gordian data team developed a benchmark model with weighted representative cost data inputs. Then, we continually researched the inputs over time to establish an inflationary index with a much higher resolution for this specific building program than our commercial City Cost Indices. The ongoing research informed a fair, market- and program-specific escalation factor for the life of several programs.

More recently, Gordian has made significant investments in Predictive Cost Data. This unique dataset uses principles of classical statistics mixed with contemporary data mining methods, intersecting a 15-year history of cost data with external econometric factors to develop structural predictive models that overcome traditional forecast limitations.

While the unprecedented, pandemic-related impacts of the last two years require that the models undergo regular redevelopment, the subdivision-specific outputs are more granular and reliable than even industry-specific parametric inflation factors.

A Data-Driven Solution for a Volatile Market

Because MILCON Independent Government Estimates (IGEs), developed simultaneously with contractor bids, rely on RSMeans Data material cost inputs and data structure, there is the potential to break down the cost by material-specific division. This could be done by using the government estimate or a contractor bid.

Gordian’s cost data could be tested to help predict the cost impact of different pre-award periods. But, more importantly, the IGE or contractor bid could be indexed at a reasonably granular division or subdivision level and weighted for material and installation costs.

The same bid could be escalated or de-escalated based on Gordian’s detailed, ongoing RSMeans Data cost research. This research could be supplemented by market-specific research, like the work Gordian conducted for FEMA in the post-disaster environment of Puerto Rico and the U.S. Virgin Islands, or by more frequent or time-specific research (i.e., in the weeks preceding the actual award).

This granular, bid-forward prediction and award-backward escalation approach would not only be more accurate than the currently proposed PIVOT methodologies, it would provide a real-world application of predictive data to determine its usefulness in better forecasting MILCON costs. This approach could save the government significant money by managing contractor risk and capturing savings as some material prices normalize in response to economic controls.

Of course, any solution for combatting runaway construction cost inflation must have the buy-in of the contractor community as well as the government. To do so, it must be based on trusted cost data research from an independent third party capable of tracking commodity-driven costs at a granular level for both cost escalations and de-escalations.

Gordian’s long history of RSMeans Data and Construction Task Catalog research makes us one such ideal third-party partner. In a time when uncertainty runs rampant, this data can help the federal government execute projects with confidence.