Executive Summary

As the construction industry moves into the third quarter of 2024, this report provides a detailed analysis of material pricing trends. Leveraging insights from Gordian’s experts, as well as Flintco’s preconstruction specialist, Klint Kimball, and DPR Construction’s supply chain leader, Tim Jed, we examine the complex interplay of challenges and opportunities. The overall stability in material prices contrasts with sector specific fluctuations, stressing the need for industry leaders to adapt and remain resilient in a dynamic environment.

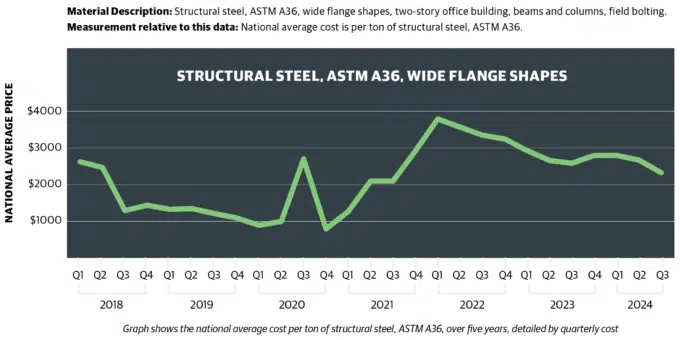

In Q3 2024, the construction material pricing landscape has exhibited patterns similar to those observed in the previous quarter. Adam Raimond, Construction Index Manager at Gordian, notes that while the overall building model has not seen significant price changes, specific sectors have experienced notable movements. Structural steel prices continue to decline, with prices per ton decreasing nearly 10% over the past three months. This trend is corroborated by industry experts who foresee continued price declines due to stable supply conditions.

Building Models Used To Calculate Price Data

Gordian’s data team researches material, labor and equipment prices and quantities in cities across the U.S. and Canada to create a composite cost model, which is weighted to reflect actual usage in the building construction industry.

To capture the types of construction activity typically performed across North America, researchers merged nine building types, which represent those most commonly found across America and Canada. They are:

1. FACTORY (one story)

2. OFFICE (two to four stories)

3. STORE (retail)

4. TOWN HALL (two to three stories)

5. HIGH SCHOOL (two to three stories)

6. HOSPITAL (four to eight stories)

7. GARAGE (parking)

8. APARTMENT (one to three stories)

9. HOTEL/MOTEL (two to three stories)

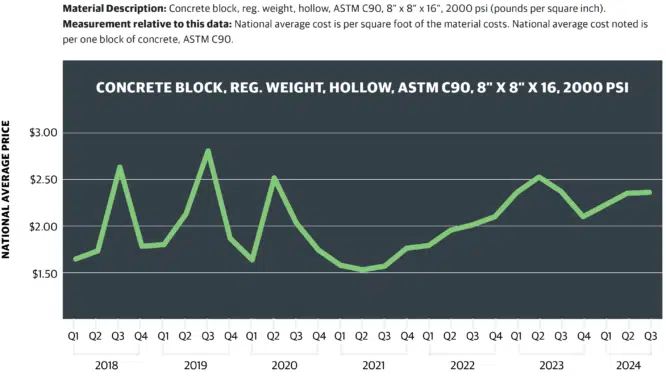

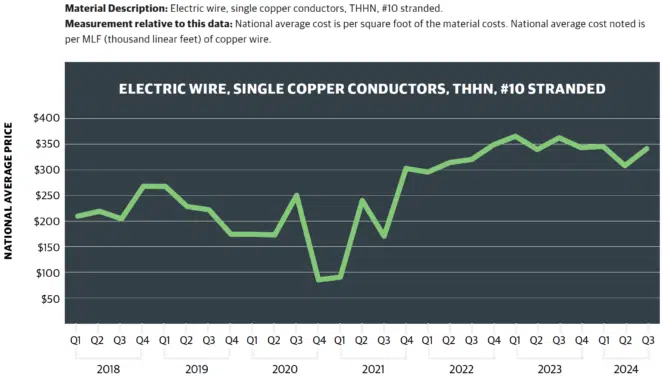

Conversely, prices for framing lumber and other wood products such as plywood sheathing and pressure-treated decking have increased for the second consecutive quarter. Despite being higher than in 2023, these prices remain below their 2022 peaks. Concrete block prices have stabilized, maintaining similar levels to the previous year, whereas copper electric wire prices are beginning to rise, driven by the increasing demand for green energy initiatives.

Tim Jed, DPR Construction’s supply chain leader, notes that despite the slowdown of cost increases and improved availability of materials, they are still receiving letters from suppliers that sometimes do not align with the actual underlying material costs. Additionally, lead times for electrical products like switchgear and copper cable remain longer than expected.

The construction industry’s pricing trends are intricately linked to global market dynamics. Geopolitical tensions and environmental events play significant roles in shaping material costs and supply chain health. According to Adam Raimond, the impact of such events can vary greatly in scope and immediacy. For instance, the sanctions on Russia following the invasion of Ukraine led to immediate supply chain constraints across multiple sectors. In contrast, the long-term effects of environmental events, such as the 2023 wildfires in Canada, are only now being reflected in lumber prices, which have risen significantly since last fall due to supply disruptions.

Tim Jed highlights several significant global market influences:

- Drought conditions have eased, and booking slots in the Panama Canal have improved to near-normal levels of 35 boats per day. However, some routes for containers are approaching $10,000 per container due to continued Houthi attacks on vessels in the Red Sea. These attacks have disrupted and reduced volume through the Suez Canal, impacting 10% to 15% of world trade.

- Geopolitical tensions are shaping the landscape. China, Russia and Iran are becoming closer allies, causing further tensions with the U.S. and resulting in additional tariffs. The U.S. is considering tariffs on Chinese metals routed through Mexico, and there is growing concern over rare earth elements crucial for semiconductors. These tensions contribute to uncertainty in material markets and may lead to additional pricing pressures.

- Rail and trucking dynamics are also noteworthy. A ruling is expected regarding whether Canadian rail workers will be permitted to strike, prompting U.S. West Coast freight facilities to handle increased volumes. Additionally, freight rates are beginning to rise after a period of low rates and excess capacity, though this has not yet been felt at DPR Construction.

How National Average Material Costs Are Determined

Gordian’s team contacts manufacturers, dealers, distributors and contractors all across the U.S. and Canada to determine national average material costs. Included within material costs are fasteners for a normal installation. Gordian’s engineers use manufacturers’ recommendations, written specifications and/or standard construction practice for size and spacing of fasteners. The manufacturer’s warranty is assumed. Extended warranties and sales tax are not included in the material costs.

Note: Adjustments to material costs may be required for your specific application or location. If you have access to current material costs for your specific location, you may wish to make adjustments to reflect differences from the national average.

Sam Giffin, Director of Data Operations at Gordian, discusses the impact of emerging technologies on material costs: “Our team is continuing to examine the impact of emergent technologies on metals costs, especially copper. The continued rise in production of electric vehicles, alongside the recent surge in data center construction plans to support AI expansion in the U.S., both have the capability to strain international supplies. The second quarter of 2024 saw U.S. copper prices hit a 20-year high; this has the capacity to escalate again if supplies worsen.”

In This Quarterly Construction Insights Report:

In this Quarterly Construction Cost Insights Report, we will be examining key data points surrounding construction material pricing. We will look at the Historical Cost Index, offering a retrospective lens on pricing trends, and the City Cost Index, providing a granular view of localized market variations. In addition, we will thoroughly explore the pricing trends of six key building materials:

- STRUCTURAL STEEL

- FRAMING LUMBER

- CONCRETE BLOCK

- CONDUIT

- COPPER ELECTRIC WIRE

- FIBERGLASS INSULATION

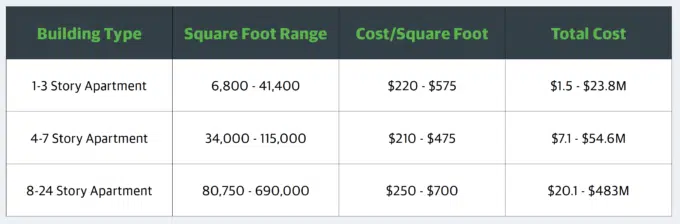

A Practical Look At The Intersection Of Material And Total Costs

Tracking the movement of individual construction costs is an interesting and illuminating exercise in its own right. Yet it’s important that we don’t lose sight of the fact that these materials will be purchased and deployed en masse as part of a project, and changes to material costs, when taken together, have a significant impact on a project’s final price tag. For practical application, let’s look at the aggregate effect of material cost changes on the expense of building an apartment complex.

AVERAGE APARTMENT COMPLEX BUILDING COSTS

The national average cost to build a mid-rise (four to seven stories) or high-rise (eight or more stories) apartment complex typically ranges from $220 to $700 per square foot. Building a standard mid-rise apartment complex that is four to seven stories high costs $7.1 to $54.6 million, depending on project-specific factors and market conditions.

FACTORS INFLUENCING THE TOTAL COST OF BUILDING AN APARTMENT

It’s been said that location is the most important aspect of real estate. That adage also holds true when it comes to construction. A quick scan of the City Cost Index table on page seven of this report provides all the evidence you need of that. For a variety of reasons, construction costs are much higher in cities like San Francisco and New York than they are in cities like Dallas and Atlanta. Even within those locations, owners must consider where they want to build. Proximity to major roadways and amenities will also drive up costs.

Hard costs like materials and labor usually comprise 70% to 80% of a project’s budget. Considering economies of scale to make savvy decisions about construction materials can help maximize a budget. For instance, structural steel costs are on a significant downslope and have been for over a year. Developers, therefore, may take advantage of these conditions and erect bigger apartment buildings while a core material is so cheap.

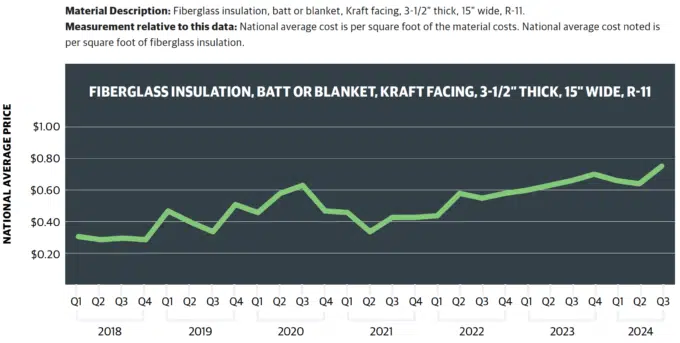

Conversely, the precipitous rise of copper electric wire costs and the climbing prices of fiberglass insulation and concrete may inspire organizations to build smaller, boutique complexes to defray those costs.

Beyond location and material costs, design complexity is a determining factor of the cost of building an apartment complex. High-end finishes and luxury amenities like lap pools and fitness centers are also consequential in terms of short-term building costs and long-term maintenance costs.

This list is hardly exhaustive, as several factors affect construction costs. However, choosing the right construction materials at the right time will go a long way to helping stretch the budget and maximize profits.

Bonus Content: How Much Does It Cost to Build an Apartment Complex? 2024 Guide

Square-foot models are used for planning and budgeting and are not meant for detailed estimates. For more information on the RSMeans™ Data Online Square Foot Estimator visit: https://www.rsmeans.com/resources/square-foot-estimating.

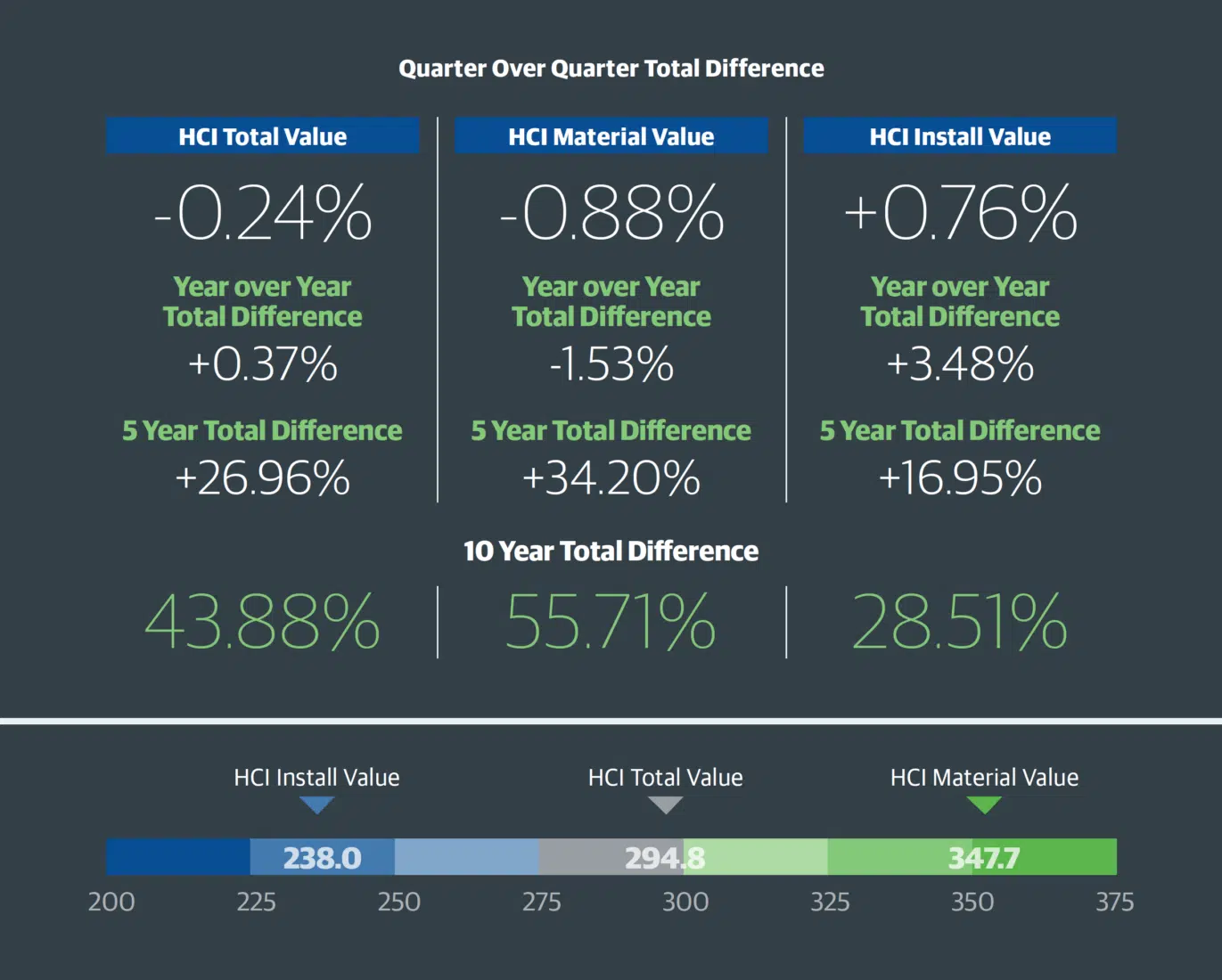

The HCI (Historical Cost Index) is an invaluable tool to track changes in the cost of construction materials and labor over time. The HCI Total Index Value represents the overall change in construction costs, including materials, labor and installation expenses. The HCI Material Value tracks the change in the cost of raw materials, such as lumber and steel. The HCI Install Value measures the change in the cost of installation labor, including plumbing, electrical and HVAC. These indices provide valuable insights, helping building industry professionals to anticipate and plan for changes in construction costs and make informed decisions about project budgets and timelines.

NOTES:

- The index values are based on a 30-city national average with a base of 100 on January 1, 1993. The three numbers are the total, material, and install index numbers, respectively, for the 30-city national average in 2024.

- The Historical Cost Index (HCI) applies the quarterly City Cost Index (CCI) updates to a historical benchmark and allows specific locations to be indexed over time. These indexes with RSMeans Data are a vital tool for forecasting construction costs and can be a valuable source of information for comparing, updating and forecasting construction costs throughout the United States.

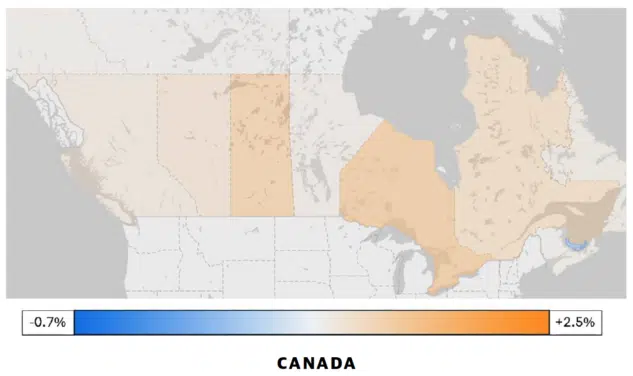

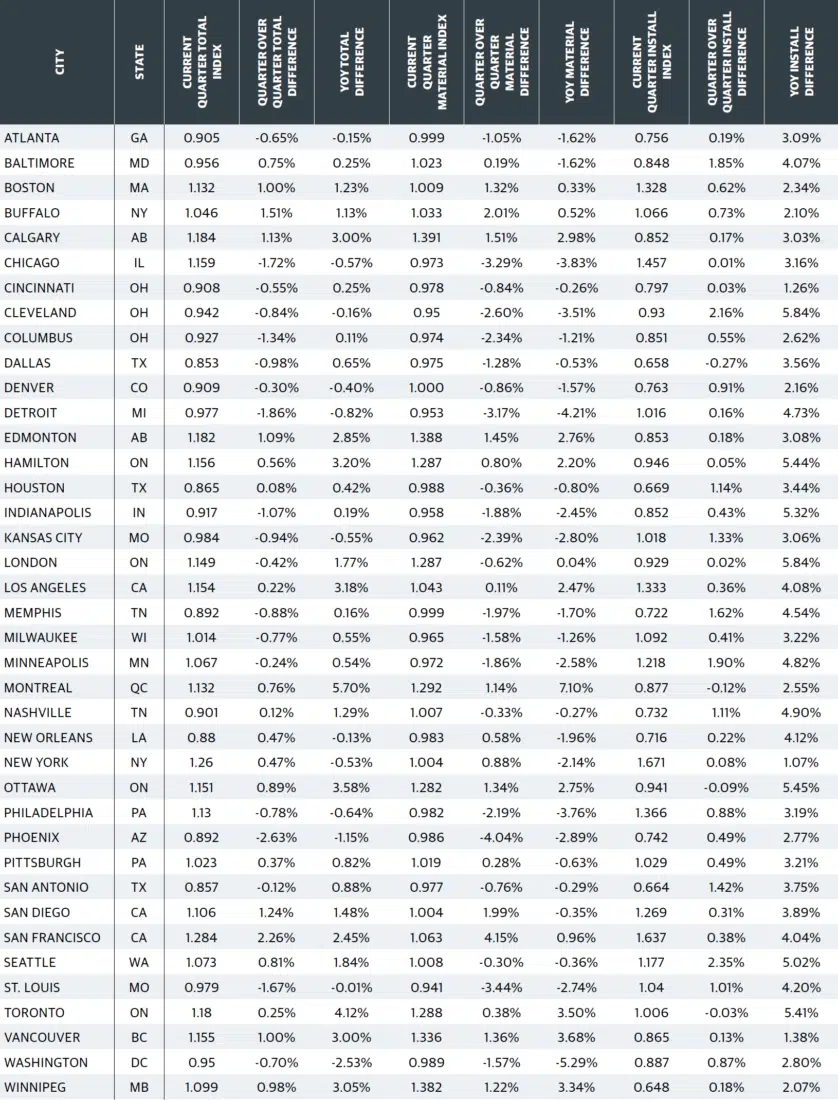

The City Cost Index is a quarterly data product designed to answer the question, “How much higher/lower are costs in my city relative to the national average?” The CCI can be used to better reflect localized pricing in construction estimates. Each quarter, Gordian’s RSMeans™ Data research team collects prices from cities across the United States and Canada, which are then compared to the national average and the current year’s annual release data to create the CCI. The City Cost Index shows a factor for Material, Installation and Total with rows representing multiple CCI divisions. Additionally, the CCI shows a Material Total, Installation Total and a Total Weighted Average.

Q2 2024 to Q3 2024

CANADA

Index values rose in most Canadian cities because of updated material price increases in lumber and masonry, including plywood, concrete blocks and clay bricks. The only province to see an average decrease was Prince Edward Island, due to some decreases in prices of various steel products.

USA

Index values shifted upward and downward by region. The east and west coasts saw increases that were driven primarily by higher prices in site work materials such as loam and pit gravel. Decreases were seen in many areas around the Rocky Mountain region. This was due to several factors, the most notable being a larger decrease in structural steel product prices in these areas in comparison to the rest of the country.

What the data says:

- Late 2022: Cost acceleration due to supply chain constraints.

- Q1-Q3 2023: Cost stabilizations/decreases persisted. Q4 2023: 6.85% quarter-over-quarter increase, but still below 2022 highs.

- Q1 and Q2 2024: No significant change in Q1 from Q4, followed by a 3.80% decrease in Q2.

- Q3 2024: Continued downward trend. This quarter saw a notable 10.68% decrease from Q2, and an 8.18% decline year-over-year, reflecting stabilized demand.

View from the field:

GORDIAN: “After a brief period of stability, prices of structural steel beams are now seeing declines this quarter. In three months, prices per ton decreased nearly 10%. Experts have corroborated this, believing that there’s little fear of supply shortages, and that price declines are likely to continue.”

DPR CONSTRUCTION: “Steel prices should continue to soften unless the U.S. successfully imposes restrictions by adding tariffs to steel from China, which is routed through Mexico or Vietnam.”

Read more on what the data says about steel.

What the data says:

- 2023: Lumber prices declined after climbs since 2020. Stabilization/decrease in Q2/Q3, slight increase in Q4.

- Q1 2024: 6.24% decrease from Q4 2023; significant year-over-year decrease of 18.78%.

- Q2 2024: Prices up from Q1 but nearly flat with Q4 2023.

- Q3 2024: National average price reported as up 7.61% quarter-over-quarter and 12.12% year-over-year.

View from the field:

GORDIAN: “Framing lumber prices increased for the second quarter in a row, along with increased prices for other wood products, including plywood sheathing and pressure treated decking. Prices so far in 2024 are higher than in 2023 but are still a distance away from their peaks in 2022.”

Read more on what the data says about lumber.

What the data says:

- 2022: High price increases driven by supply constraints.

- 2023: Prices rose in Q2 but at a lower rate than Q1; slight declines in Q3 and Q4.

- Q1 2024: 6.16% increase from Q4 2023. Q2 2024: 5.80% increase from Q1 2024, but a 7.14% year-over-year reduction, continuing the trend of stabilization.

- Q3 2024: Prices stabilized with a slight increase. National average price is $2.38, reflecting a mere 0.42% quarter-over-quarter increase and a 0.42% year-over-year decrease.

View from the field:

GORDIAN: “Concrete block prices have stayed stable this quarter, and are at about the same price as they were last year. Prices heading into Q3 the previous year were less stable.”

Read more on what the data says about concrete block.

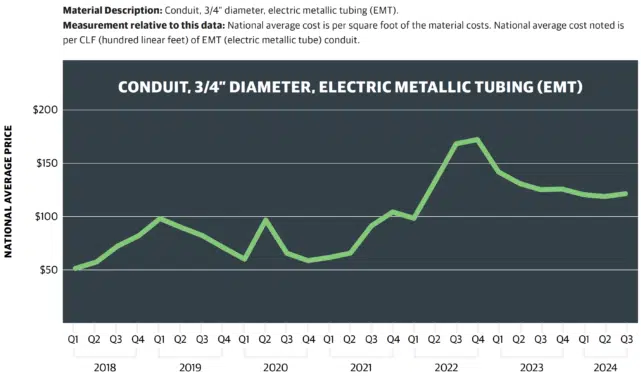

What the data says:

- Late 2022: Significant price escalations driven by international supply chain issues.

- 2023: Prices slowly fell from 2022 highs, with a slight increase in Q4.

- Q1 2024: Prices down just over 4% from Q4 and decreased almost 15% year-over-year, continuing to fall slightly into Q2.

- Q3 2024: Prices stabilized. National average reflects a 2.21% quarter-over-quarter increase and a 2.93% year-over-year decrease.

View from the field:

GORDIAN: “There’s currently an unexpected surplus supply of aluminum (what conduit is made of), and as a result that has kept conduit prices consistent for the last year. This trend should continue.”

Read more on what the data says about conduit.

What the data says:

- Late 2022: Significant price escalations driven by international supply chain issues.

- 2023: Prices increased into 2023, with a minor decrease in Q4 from Q3.

- Q2 2024: Significant 10.83% price drop since Q1, with a 9% year-over-year decrease.

- Q3 2024: Prices increased. National average cost is $341.71, with a 10.62% quarter-over-quarter increase and a 5.85% year-over-year decrease.

View from the field:

GORDIAN: “Prices for copper wire from suppliers are starting to see small price increases going into Q3, and it’s a certainty that prices are going to continue to climb in 2024. It has been

predicted for a while that copper demand is going to rise due to its common use in green energy initiatives.”

DPR CONSTRUCTION: “Lead times for electrical products like switchgear and copper cable remain longer. … Copper product prices will continue to increase.”

Read more on what the data says about copper electric wire.

What the data says:

- Early 2022: Supply shortages drove up prices after two years of decline.

- 2023: Prices held at higher levels, creeping up each quarter.

- Q1 2024: Prices decreased by under 6% from Q4, with a year-over-year increase of more than 9%.

- Q2 2024: Pricing relatively unchanged from Q1, with a minor downward trend of under 3%.

- Q3 2024: Significant price jump. Current price is $0.77 per unit, with a 16.67% quarter-over-quarter increase and a 13.24% year-over-year increase.

View from the field:

GORDIAN: “… insulation remains on allocation.”

Read more on what the data says about fiberglass insulation.

Forecasting the next several months, building product costs are expected to increase overall by the end of 2024. Adam Raimond suggests that while sectors experiencing recent price declines, like steel, are unlikely to see further significant drops, those with rising prices, such as copper and drywall, will continue to face supply pressures. Labor market dynamics also significantly impact material costs. The ongoing shortage of skilled labor has resulted in rising wages across the construction industry, contributing to higher overall project costs.

Tim Jed emphasizes that reduced labor availability and increased cost inputs lead to higher purchase prices on products or lower margins for producers. Higher pricing is passed on to owners, who are already under pressure due to

the higher cost of capital.

Lower margins for providers, if sustained over a long period, could hurt their profitability and viability, creating long-term challenges.

In terms of sustainability, the industry is witnessing a growing trend towards eco-friendly construction materials. Klint Kimball observes the increased use of mass timber in large projects, which enhances sustainability and reduces carbon footprints. However, the benefits are somewhat offset by the negative impact of long shipping distances.

Additionally, the adoption of offsite fabrication and prefabricated assemblies is gaining traction, offering improved construction schedules and mitigating onsite labor shortages while ensuring high-quality finishes.

Tim Jed details notable trends in sustainable materials, including the increased consideration of mass timber as building codes permit its use in more applications. There has also been progress in the industry with new mixes for lower carbon concrete, though these are still in the early stages. Jed also notes a rise in the use of healthier materials with lower VOCs and those produced with lower Global Warming Potential (GWP). DPR Construction has been working with the nonprofit Mindful MATERIALS — a free online platform that provides information on the environmental and human health impacts of products from leading manufacturers — to help inform its new material transparency framework adopted by major green certification systems. They also have a dedicated team focused on helping customers lower the embodied carbon of materials for their projects.

Jed also points to the growing influence of emerging technologies on construction material pricing and supply chains. He states, “There is a lot of discussion about the use of AI in the supply chain, but at present, it is not advantageous for general contractors due to their internal systems, the information they track and own, and how that information is stored. As these systems evolve, there should be more opportunities to utilize AI to make better real-time decisions.”

The construction material market in Q3 2024 presents a mixed landscape of stability and volatility. While overall prices remain relatively unchanged, sector-specific trends highlight the importance of strategic adaptability. Geopolitical and environmental factors continue to influence material costs and supply chain health, necessitating proactive planning and robust relationships with suppliers.

By staying informed and adaptable, industry leaders can navigate the complexities of the construction material market and position themselves for success in a rapidly evolving environment.

The Following Supply Chain and Preconstruction Subject Matter Experts Contributed Their Views for this Q3 2024 Analysis:

GORDIAN

- Adam Raimond, Construction Index Manager

- Sam Giffin, Director, Data Operations

DPR CONSTRUCTION

- Tim Jed, Supply Chain Leader

FLINTCO

- Klint Kimball, Director of Preconstruction

Additional Resources

Share this: